Market update July 2024

Market update July 2024

The first half of 2024 is now behind us. We see some striking developments in the market that we would like to share. First of all, we look at production in the Far East and transport to Europe. We then zoom in on developments in the Netherlands/Europe and the consequences for us and our relations.

Production in Southeast Asia

Prices for fasteners have remained low over the past six months. The cause of this is the relatively high inventories in Europe and declining demand. In addition, the demand from China is also very low, the construction sector there is in dire straits. There is therefore an ample supply of raw materials, pre-materials and production capacity.

Our suppliers are struggling with a low order intake. Various manufacturers work 4 days a week because there is too little work.

Throughout the chain, from blast furnace to galvanizing plant, people are satisfied with minimal results. The result is the current low price for the production of fasteners. It is expected that product prices will not change for the time being.

Transport to Europe

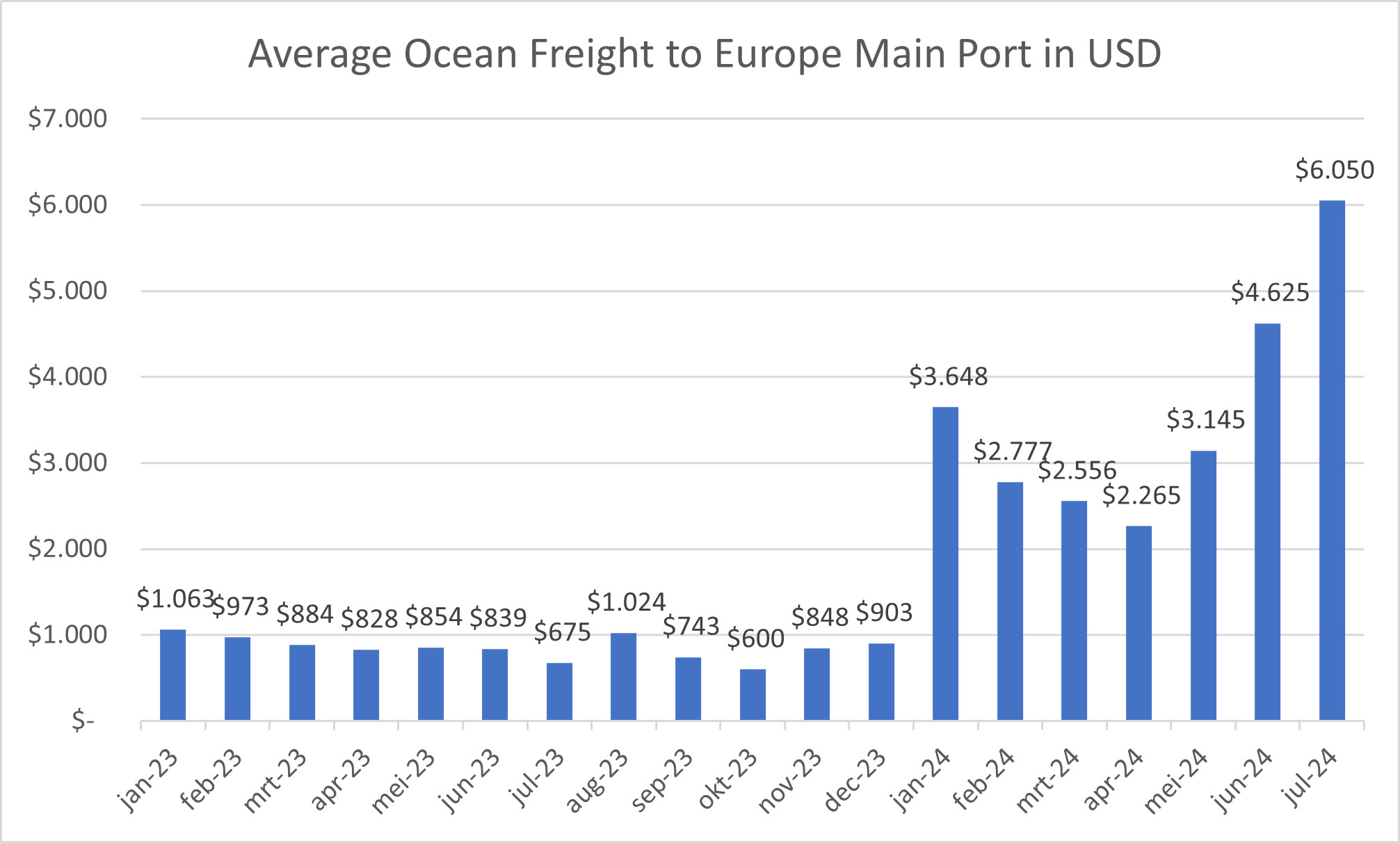

Due to the shelling of ships in the Red Sea, shipping companies are choosing to sail around Africa. The transport time has therefore been extended from 4 weeks to 6 weeks. The return journey also experiences this delay. This, together with various other geopolitical developments, is causing a shortage of containers. This scarcity leads to a gigantic price-increasing effect within a few months. The graph below shows the development of freight prices from January 2023.

Not only are prices rising rapidly, the shortage of containers also affects the Expected Time of Departure (ETD). Shipments often have to wait 2 to 5 weeks for an available container. This phenomenon is acute and takes many importers by surprise.

Availability general

Stocks of fasteners at European importers were large for a long time. This meant a lot of price pressure to make inventory liquid. On the other hand, due to the resulting long delivery times from the Far East, we notice that stocks are currently shrinking rapidly. This sometimes puts pressure on availability. European importers are currently raising prices among themselves in anticipation of the expected shortage.

Availability Kobout

Our stock is at a reasonable level and we can serve our customers in an acceptable manner. The many years of relationships with our partners (producers) are paying off. However, due to significantly increasing prices from European traders, we reserve the right to adjust prices individually if our stock is insufficient.

Market developments in Europe

Many companies are struggling with declining demand. Together with the high interest rates, this provides a strong impetus to reduce inventories. We see this immediately reflected in the structure of our orders. The order frequency increases, but the volume of orders decreases.

As a result, the transport costs per order are becoming increasingly important, while these costs are also increasing due to inflation and because our transporters want/need to electrify the fleet step by step.

In addition to the regular, significant wage increases, we are faced with increasing regulatory pressure from governments. Reports for CBAM, sustainability and, for example, registration of staff commuting.

We do everything we can to maintain prices and stocks as much as possible, but there is a real chance that we will be forced to implement a price increase in the coming months.

If you would like more information about current market developments, please contact your Kobout contact person.